A staggering 10% of China’s surface water is severely contaminated and defined as an ‘Inferior Grade V’ waterbody, according to 2016 government data.

This means, in simple terms, it can’t be used for anything. That’s clearly bad news for China. But, at the same time, it presents a big opportunity for international wastewater tech companies which can help address the problem.

Building on the recent article by my colleague Micah Hostetter about the lightning growth of China’s general envirotech sector, the wastewater treatment segment deserves particular attention.

10 measures | 238 actions

To improve China’s rivers, lakes, coasts and aquifers, which have become chronically degraded following decades of break-neck economic growth, the country’s central government is urging industry and local environmental protection bureaux rigorously to implement the ‘Water Pollution Control Action Plan’ — known as the ‘Water Ten Plan.’

Issued in April 2015, this plan sets out 10 broad remedial measures, which break down into 238 actions with deadlines and government departments responsible for each.

The targets include:

- A significant reduction in the number of highly polluted water bodies – with over 70% of water in seven key rivers to be brought up to Grade III or above

- Improving the overall quality of the ecological environment by 2030, and

- Transforming the quality of the overall ecological environment by the middle of the 21st century

Business opportunities

China certainly can’t achieve these targets alone, so the Water Ten Plan is creating commercial opportunities for western water tech firms which can help. And many international companies, including SUEZ, Veolia and Gradiant, are already active in wastewater projects and busy cultivating partnerships with the government to seize the moment.

So, what are the main areas of opportunity? These break down by geographic area, wastewater type and technology.

Geographical focus

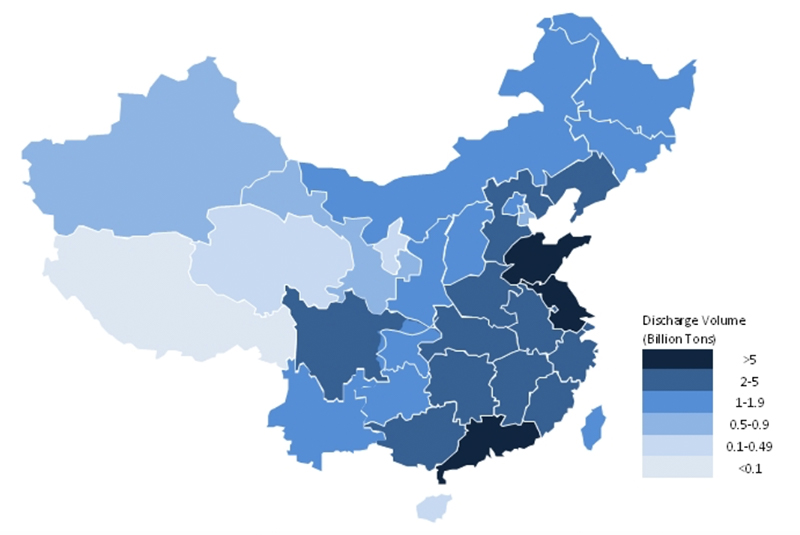

Most of China’s population and industry — and, consequently, its pollution — are clustered around 1. Beijing, Tianjin & Hebei, 2. the Yangtze River Delta (Shanghai & surrounding provinces) and 3. the Pearl River Delta (the Guangzhou/Shenzhen region in the South). This means far more wastewater is discharged in these coastal areas than inland.

As a result, these three regions face tougher standards and are required to meet targets one year before the national deadline – making them particular areas of commercial opportunity.

Annual wastewater discharged by province

Source: CGiS, China’s Statistical Yearbook on the Environment, 2016

Municipal wastewater

The municipal wastewater treatment sector nationwide is another primary area of investment.

To alleviate the pressure of raising capital for the large municipal projects that water remediation requires, local government bodies favour working with companies via the PPP (public-private-partnership) model.

For construction of a wastewater treatment plant, municipal organisations typically sign 15-20-year contracts with project operators, providing a subsidy per unit of wastewater treated. Operators also get revenue from treatment fees paid by factories which discharge specialised sewage that requires extra treatment.

France’s SUEZ ENVIRONMENT is one of the most influential western companies here, having been active in this area for over 30 years.

SUEZ works with more than 20 Chinese municipal bodies under the PPP model. It provides domestic water to 20 million people and has built more than 240 water and wastewater treatment plants, supplying investment and operational expertise. It also provides consultation, design and construction services to eight Chinese industrial parks, covering the complete water lifecycle.

Driven further by the 13th five-year plan, local government bodies are now expanding municipal wastewater treatment coverage from urban to rural areas. At the same time, replacement of old municipal infrastructure in regions such as Guangdong, Shandong and Shanghai will boost market growth.

But whilst SUEZ will doubtless capitalise on this, companies with less experience in the Chinese market may find openings in municipal wastewater treatment harder to come by. This stems from a combination of restrictions on market access and a preference for domestic players – with higher barriers to entry than the industrial wastewater treatment sector. The openings are there, but taking the right approach is essential.

Industrial wastewater

Industrial wastewater is another vital area of growth as, under the latest regulations, factories will now have to treat wastewater to far higher standards or employees potentially face jail time.

In Xiamen, the corporate representative of an electroplating operation was recently sentenced to eight months in prison for illegal factory discharges. And increasingly stringent environmental mandates will drive demand from industrial companies forced to embark on new investments and upgrades.

Regulations dictate, for example, that various conditions need to be considered before deciding how much chemical oxygen demand (COD) a factory is allowed to discharge in wastewater — whether the factory was built before 1998, its location, the industry in question and even the season. But, in general, factories are required to reduce COD to 100mg/L or less — 50mg/L for those in the key geographic regions. And the wastewater industry and government are now talking about making 50mg/L a standard nationwide.

As a result, most factories in China will need to upgrade their treatment processes to avoid big penalties.

Heavily polluting and water intensive industries have also been singled out for particular pressure. The following 10 are targeted for technological upgrades and emission reductions, making them good focus areas for international companies:

- pulp & paper

- coking

- nitrogen fertilizer

- textile dyeing & finishing

- agriculture food production & processing

- pharmacy production

- leather production

- pesticides

- electro-plating

- non-ferrous metals

Focus technologies

Industrial wastewater treatment technologies, especially those able to lower ammonia nitrogen content or treat reverse osmosis (RO) reject, are much-needed in China.

Techniques for rapidly breaking down long-chain compounds and making them treatable by bio reactors are also greatly needed by the heavy chemical industry, as are technologies to lower ammonia nitrogen levels to suit the new class I standard (NH3-N lower than 8 mg/L in the three key areas, 10 mg/L in other areas). In addition, several industries need to find a solution to remove high-strength ammonia nitrogen from wastewater or they face suspension of their operations.

The effects of hyper-saline concentration on biochemical reactors and the treatment of RO reject wastewater in China’s pharmaceutical and chemical industries also remain problems in need of effective answers.

Since wastewater effluents from large industrial operators in China usually have huge flow rates — sometimes as much as 300-2000m3/h — technical adjustments will typically need to be made by western wastewater device manufacturers for China. But, given the market potential, these are well-worth addressing.

Vast, if complex, markets

So, China has a deep-rooted wastewater problem which it has set tough targets to tackle, but cannot achieve alone. This brings big openings for western firms with the right technologies – particularly in China’s three key geographical areas and the fields of municipal and industrial wastewater treatment.

The market is inevitably complex. The approach needed varies by product, sector and province. Target customers also differ greatly – ranging from wastewater EPCs (engineering, procurement and construction firms) to the end-user plants and refineries.

It’s vital to fully understand the customer and the regulations in each case, to get expert advice and develop the right strategy. But do this well and you’ll find the opportunities are huge.

To explore if Intralink could help you target China’s wastewater sector, contact Alex Gover at alex.gover@intralinkgroup.com