Thirty years ago, the economics of East Asia were completely different.

Japan – the world’s second largest economy – was in meltdown after the collapse of the stock market. The Chinese economy, in contrast, was in take-off mode, but fraught with danger for any over-enthusiastic foreign investor. Korea was known for shipbuilding and its dangerous neighbour but, as the 27th largest economy, was not on the radar of many business leaders.

Back in 1990, it would have been difficult to predict how East Asia would change over the years that followed. It would also have been a brave or foolish man to bet his livelihood on the region.

Nevertheless, I set up a Japan-focused business in 1990 – just as its economic bubble burst; we set up in China in 2002, just before the SARS epidemic; we only succeeded in Korea on our second attempt; and we opened in the USA in 2008, six months before global financial meltdown.

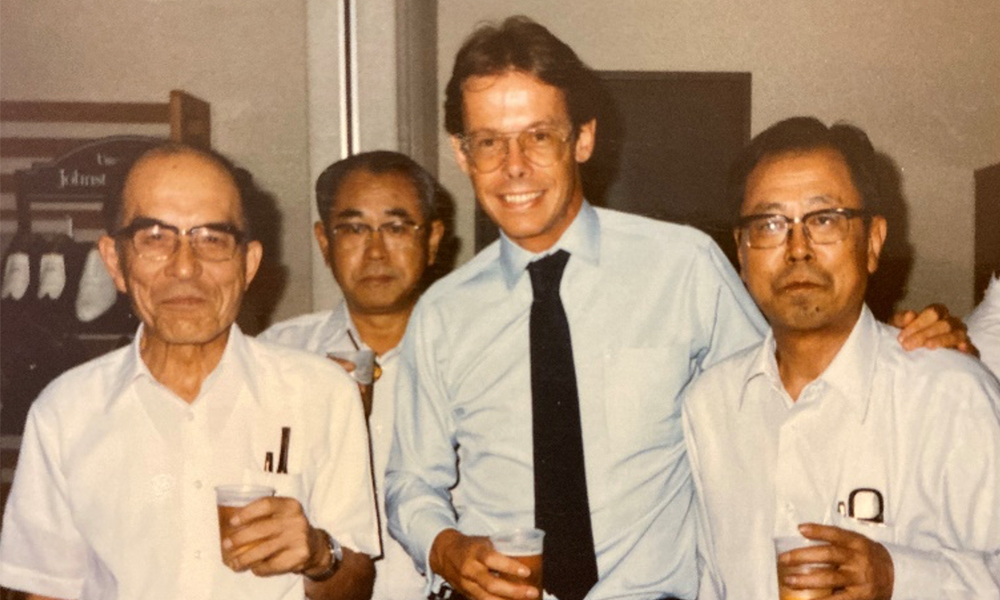

Intralink founder James Lawson in Japan – 1990

On the face of it, these should have spelt disaster; but these early experiences served us extremely well. And in all these markets, we found ourselves in the right place and well able to exploit the advantages when the time became right.

No business plan

I had no business plan back in 1990. I was 42 and out of work with three children, a mortgage and fast-dwindling savings when I met Philip Robinson on the touchline of a kids’ hockey match.

Robinson had a contract manufacturing healthcare business that was being squeezed by the big supermarkets. I bet him a thousand pounds that I could find 10 products in Japan which he could sell under his own brand through British pharmacies.

This wasn’t quite as daft as it appears as I’d lived and worked in Japan and spoke some of the language. On my return from Tokyo, Robinson adopted two of my suggested products: a magnetic therapy device and a range of hot and cold bandages. This was satisfying, but one of the products he didn’t choose was a graduated compression stocking from Atsugi Nylon, a major Japanese hosiery maker.

Growing awareness of the dangers of DVT on long-haul flights prompted me to return to Japan with a plagiarised version of a European hosiery industry report which I presented to Atsugi, suggesting they appoint me to represent them in the UK.

Uncharacteristically – because the Japanese were known to be cautious and frustratingly slow to commit – we agreed a monthly fee with no scope of work, no timeline, no targets and no contract! This stroke of luck covered some of my overheads and continued for a remarkable 14 years – although, to be fair, during the latter part, Marks and Spencer were buying three million pairs a year of these Japanese stockings.

With early Japanese hosiery client Atsugi – mid 1990s

We weren’t on commission and it was clear that being a facilitator for a Japanese corporate was not going to make for a sustainable business – that our focus had to be on securing UK clients interested in building businesses in Japan. (Ironically, 25 years later, we now have a fast-growing business representing major Japanese corporations seeking innovation partners in Europe.)

Eclectic UK firms

Over the next four years, we acted for an eclectic group of UK firms. This included working for Transport Development Group to secure logistics business from Japanese manufacturers in the UK; for Amec, seeking Japanese investment for a property development near Manchester Ringway Airport; for British Technology Group, to secure licensees for their physical science patent portfolio; for London Contemporary Art, to promote their artists in Japan; and for Links of London, looking for Japanese distribution and franchise partners.

It was exciting, but I was travelling to Japan seven times a year, working in Tokyo out of a bedroom office in a friend’s building and operating across two time zones. I had three retired Japanese contacts helping me on a part-time basis. The business was fragile; it was difficult to see how we could scale; and easy to see how a couple of bad debts would sink us.

That said, I loved Japan and found a level of energy and commitment I last remembered when rowing for my school at Henley. I was a poor consultant if the job required a 40-page report, but prospects responded well to being told the truth in a ‘one pager’.

I quickly learnt that clients hated paying expenses and preferred a fixed fee. This worked in our favour because they knew how costly Japan was, but I was nevertheless flying in the lowest cost seats, getting the bus to meetings, staying with mates and eating ‘stand up’ noodles rather than beer-fed Kobe beef to cover the overheads.

Treating every expense as my own and looking after the pennies has served us and our clients extremely well.

In the same vein, after one bad debt, I soon found out that invoicing for settlement on the 20th of the month gave us a much better chance of being paid by the 30th.

Patience was never my strong suit, but I discovered the value of staying in touch and that never giving up was part of the process of establishing the trust and credibility to secure a client. The same sort of patience (and frustration!) was, of course, required by our clients to secure substantial and sustainable business with Japan.

We have many examples of courtships stretching over years, but I recall one company in the healthcare sector which was a prospect for seven years before becoming a client, but the payback was that they then remained with us for over four years.

Above all, I found I had an excellent rapport with the Japanese and knew exactly how, as a foreigner, I could circumvent the conventional rules of engagement.

This proved invaluable in a country where it was difficult to figure out who was in charge or when ‘’Very interesting, we must study” meant “We have no interest whatsoever, but come back with more information to help us understand our competitors”.

For technical products, a foreign company believing it was making progress could get endlessly ensnared in the R&D verification and approval process if they did not engage regularly at the right ‘working’ level in the commercial department.

Game changing clients

This was all well and good, and we were making a profit. But the returns hardly justified the effort. It was effectively a one man show and I needed a game changer – and this duly came in the form of two clients.

The first was an institutionally-backed company called Queensgate Instruments, who were frustrated that – selling through an agent – their exports to Japan had stalled at £1 million. They wanted help to clear the blockage and establish their own sales office in Japan, selling directly to user companies. We set up a newco and acted as interim general manager.

As it turned out, this only lasted seven months as Queensgate was acquired by an American company and we were promptly terminated. However, the experience was invaluable and, as it happened, over the following 10 years we acted for three Queensgate ‘spinouts’ and twice for one of its original directors. How true the adage that, if you do a good job, what goes around comes around!

The second was Cabouchon, who were selling faux jewellery through a network marketing (pyramid) system. The jewellery was big and loud and seemed unlikely to appeal to the demure Japanese, but a US company called Amway was having enormous success with network marketing using housewives. We’d undertaken an opportunity assessment and recommended they enter the market, but what we had not bargained for was that they would ask us to do this for them over the following 12 months.

Following our involvement, Cabouchon went on to become an enormous success in Japan, but then – beset by product quality and supply problems – suddenly imploded.

These were game changers because, over the course of a few months, we had gone from providing consultancy advice to delivering implementation and business development services.

Greg Sutch arrives

It was about this time that I met Greg Sutch at an industry function in London. He was 26 and had lived in Asia before completing a degree in geography and Japanese. He was smart, passionate about Japan and wasn’t enjoying his job with Japan Airlines in London. It helped that I’d met his father in Tokyo 20 years before!

Greg became our third full-time employee and relocated to Tokyo.

James and Greg outside our first Tokyo office – 1998

I continued to visit Tokyo regularly, staying at cheap hotels, cycling to the office, walking to meetings, missing lunch and doing anything else I could think of to keep our overheads down. But I was no longer looking over my shoulder and worrying about delivery In Japan.

Greg and I spent every spare evening drinking beer with clients and Japanese contacts. This provided a relaxed atmosphere in which to interpret the nuances of that day's meetings with inscrutable customers, whilst building strong relationships with our clients.

We were building a growing network of connections at every level in Japanese companies. We soon grasped that the Japanese ‘ringi’ system of bottom-up management meant it was section managers, rather than directors, who effectively called the shots.

Our ability to weave our way at this level as Japanese-speaking foreigners provided insight and influence that was highly valuable to our western clients.

In one late night brainstorming session, Greg said he felt we were acting as a ‘surrogate’ for our clients. This was a light bulb moment. The word implied that the client would – and should – set up on their own, but not till the business had proved itself. In the interim, understanding the costs and risk of failure, the client would assign the business to Intralink.

We effectively provided the client with a stepping stone into the market: an interim physical presence where we would act for and as our client, building partnerships and securing deals, ready to transfer control when their business was ready and able to stand on its own commercial feet.

The development of our ‘Surrogate Sales Programme’ has been pivotal. In an exceptionally high-risk/high-return environment with enormous market potential, we provided a low-risk implementation service. This remains the cornerstone of our business today.

The Wild East

I’d been born in Shanghai and my parents fled the advancing communist forces of Mao Zedong in 1949, so it was no surprise China was also on our radar. The opportunity came in 2002 when we secured a project to identify senior Chinese business executives in Hong Kong who could serve as non-exec directors in companies UK investment firm 3i wanted to acquire in Greater China. Although the work was focused on Hong Kong, it provided an excellent insight into the opportunities for us in the country.

We first opened in China in a small corner of a residential flat with one member of staff and no clients. It soon became evident that, while the transparency and integrity of the surrogate sales model appealed to western companies, Chinese business protocols were totally different from Japan’s.

China was the Wild East. Everyone was in a hurry to achieve personal and corporate success. Mandarin-speaking foreigners like us were intriguing, so we gained access into companies – but only for as long as we could be exploited.

We soon learnt the institutionally-backed tech companies that had become a large share of our client base were reluctant to engage us in China. The trade opportunities were about to explode as China had recently joined the WTO, but, for many, the intellectual property risks posed an insurmountable stumbling block.

We struggled to make serious progress for 10 years, but we were working hard and undertook fascinating projects in fields as diverse as ostomy, civil engineering, welted shoes, biocides for bird flu, geotextiles for strengthening riverbanks, biodegradable plastics for green houses, Armagnac brandy, wind turbines, golf training aids and sugar cultivation.

I recall one of our clients – a western nappy maker – who asked us to assess its opportunities in China. We found most middle and lower middle-class Chinese had maids and used newspaper instead of nappies – with the daily cost of a maid not much more than the cost of an imported nappy! But the real surprise discovery was that our client’s brand was already the market leader, based on parallel imports from US wholesalers, about which our client had no idea.

Greg transferred to Shanghai as MD of Intralink China in 2005 and was replaced as MD of our Japan operation by Alan Mockridge. Alan had joined in 2000 and would go on, in 2008, to be President of our US operation.

Early Shanghai team - 2008

South Korea… then the US

It took us two attempts to establish in Korea, but in the interregnum, the country climbed from the 27th largest world economy to 20th and it is now tenth. Its economy is heavily dependent on the export of ships, motor vehicles and electronics but, as its response to coronavirus has shown, its 52 million people are tech savvy, environmentally concerned and 5G-connected.

Our operations in Korea have had a major licensing success with environmental and energy technologies in particular. It is, of course, in the shadow of North Korea, but this is accepted as the norm and has had little impact on the growth of its economy.

In late 2007, I travelled with Alan Mockridge to the US to see if we could deepen our presence in the market. At the time, we had five US clients and some serious credibility from one – DivX Networks – which had raised $145 million in an IPO on the back of our work for them in Japan.

Our first appointment of the day was with the President of THQ Wireless, who we were representing in Japan. Not only did he fail to turn up; we were terminated without notice and left with a $15k bad debt.

It wasn’t the best introduction to North America, but, undeterred, Alan and his family moved to the West Coast in April 2008.

The timing was somewhat unfortunate with the collapse of Lehmann Bros which followed that September. That year was, in fact, the only one in our first 30 in which our revenues declined. But, having operated and budgeted on a conservative basis, the impact was minor and temporary.

Sector specialisation

Until five years ago, we were country specialists and sector agnostics, but we have now developed strong technical and sector expertise across the medical, energy, automotive, digital media, software and telecoms fields and more.

The benefits of this approach are well illustrated by our latest client wins.

We’re helping US AI firm Citrine Informatics to get into Japan’s manufacturing sector; French company Metron to sell its energy intelligence platform to factories in Japan and Korea; British electric vehicle tech firm Spark to target China’s huge automotive market; and we’ve just secured a £36 million deal in Korea for UK clean energy firm Ceres Power.

All this is a long way from where we started, seeking franchisees for intimate apparel retailer Knickerbox, and investors for a property development in Manchester!

Securing a £36M deal for Ceres Power in Korea – 2020

Financial standing

At the end of the 1980s, I’d been told that redundant execs from big companies always fancied themselves as consultants, but it was a graveyard where, to be considered successful, you needed at least four clients and annual revenues above £160k. With that in mind, I thought we were winners when we reached that revenue target in three years. But I never felt the business was safe until we reached a million, which took us 15 years.

Ultimately, the tangible evidence of success has been the financial results, and by that measure our ability to raise an unsecured loan of £1 million in 2011 as part funding for a management buyout was significant – the more so, perhaps, since I had not actually visited the Bank since setting up an account in 1990. And to the chagrin of the Bank, we then repaid the loan in half the allocated time!

But I would prefer to focus on what I would consider the most fulfilling aspects of the journey: that we have been able to create an environment, secure the clients and provide the challenges that have underpinned the motivation, the stretch, the job satisfaction and the loyalty of the team.

A key matrix is the relationship between what we are paid and the time clients remain working for us, and we have done well on both counts. Our longest-standing current client has been with us for 12 years. The record is 14 years, which goes to our second-ever client, Atsugi Nylon, in Japan.

And along the way, we have learnt as much from our clients as they have learnt from us. It has been a two-way street: we gained specialist sector and technical knowledge and they gained a thorough understanding of the opportunities and threats they faced and an invaluable set of contacts.

Referrals have been the biggest source of new business, often as a result of tech companies being acquired or restructured, and we have been able to follow the CEO as they’ve moved on to new ventures.

And it’s been gratifying to have received so many endorsements from clients over the years that have reassured us we were delivering real value – such as the CEO of Cambridge Positioning Systems, who said “I’d been coming to Japan for 15 months, securing apparently positive interest, but I only really understood what was going on after the first round of calls with Intralink.”

Looking back …

Looking back, we have invested heavily in our people and systems and this has paid us back handsomely. Our foundations were good, the surrogate model has proved robust and our core Asian markets have remained substantial and difficult for western firms to penetrate unaided.

In any retrospective, there are, of course, many who deserve recognition for contributing enormously to the company. This is decisively a people business and we have worked hard to create a strong team spirit.

We have always been on the look-out for fluent language speakers with big attitude – people who are fearless when it comes to making cold calls in the local language, have strong social skills and a great sense of humour. The joke was that we liked to hire people who could ski (and, at a push, ‘board’) because we enjoyed team-building weekends on the slopes with rebellious and generally fun-loving folk!

Of our 90 staff today, over a dozen have been with us more than a decade. One of them, Huw Thomas, joined in Japan 17 years ago as a semiconductor expert and ex-rugby commentator and is now in Oxford, running our fast-growing business advising Asian corporates. He’s working alongside Noel Pritchard, who joined in 2002 for three years, left for eight and then returned in 2015.

Zhao Le started in Shanghai as office assistant in 2006 and is now President of Intralink China. Jeremy Shaw, Head of our Asia operations, has been with us for 12 years.

And looking forward …

The coronavirus is proving a challenge for us, as it is for many, and while our revenues and profits may dip slightly, we – and our clients – are already feeling the benefits of rapid economic recovery in Asia, making ‘our’ territories the best place in the world for many western firms to be picking up business.

Aside from the inevitable economic fall-out from COVID-19, there are, as always, plenty of unknowns ahead: the US-China trade impasse; the implications of a change of US President; continued threats from North Korea; and China’s military build-up, to name a few.

But what is beyond any doubt in my mind is that the economic importance of East Asia is huge and will keep growing. And that Intralink, our employees and our clients will keep growing with it.