The last year or so has been a rollercoaster ride for the global Invitro Diagnostic (IVD) market. In early 2020, business came to an abrupt halt as hospitals and clinics closed or reduced all non-essential treatments. However, the demand for SARS-CoV-2 testing rapidly changed the sector’s dynamics and, globally, we’ve seen increasing interest – especially in molecular diagnostic (MDx) technologies.

China is a particularly dynamic market as its COVID response has led to a fast return to business-as-usual, creating opportunities not currently found in other markets.

This was clear from the China Association of Clinical Laboratory Practice (CACLP) show in March – the country’s hottest IVD event - which ran as a physical expo as usual. Our China team were busy there representing clients who were unable to travel through our Surrogate Exhibitor service, holding customer and supplier meetings and capturing the latest industry trends – as you can see from this short video.

And the dynamism of the Chinese market is clear from other industry events and from looking at the pace of innovation coming from many of its players.

This represents great opportunities for international IVD companies – to source complementary technologies, form partnerships and find investment opportunities in China.

Here are our insights into the biggest MDx trends and the country’s most exciting players.

Digital PCR

Digital PCR (dPCR) is seeing a great deal of activity. Technologically, while most manufacturers in China have used microdroplet-based dPCR, we’re now seeing interest in alternative technologies such as continuous flow and chip-based dPCR.

Prior to 2020, few Chinese dPCR companies had applied for National Medical Products Administration (NMPA) authorization - that was for overseas dPCR technologies. But this past year has seen an influx of Chinese entrants to the dPCR market who have applied. Guangzhou Forevergen, Rainsure Bio, PilotGene and Turtle Tech have all obtained NMPA certificates for their proprietary digital PCR instruments and, in 2021, Sansure Bio entered the market. By the start of May 2021, there were eight dPCR instrument NMPA authorizations.

So rather suddenly, we have a highly competitive Chinese market for dPCR manufacturers. Their focus is broad, with applications including genetic-specific mutation detection in early cancer screening and liquid biopsies, companion diagnostics and the highly active area of pathogenic microorganism detection. With the rising incidence of infectious diseases and need to detect genetic disorders globally, these Chinese manufacturers are moving rapidly and are companies to watch.

Get in touch to discuss your opportunities in China

Fourth-generation sequencing

Sequencing is dominated by Illumina and BGI with their second-generation technologies. But we’re now seeing MDx companies enter the market with third and fourth-generation technologies.

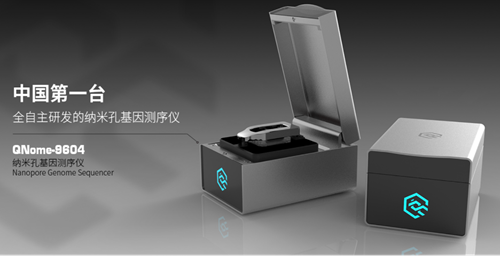

In 2020, we saw the first Chinese startups in the field, RH Genetech and Qitan Tech, emerging - both using nanopore, chip-based, label-free, single-molecule, fourth-generation sequencing. These sequencers offer high read lengths, are fast, easy to use and more portable than second generation platforms. Applications include detection of genomic structural variations and metagenomic sequencing.

Qitan Tech (The QNome-9604 - shown below) claim read lengths greater than 150Kbp, producing 500Mb sequence data within eight hours. Separate chip design promises to reduce a single sequence cost.

Qitan Tech raised USD $15.38 million in series A funding from the Yahui Precision Medicine Fund and Yinxinggu Capital and, in total, have attracted more than USD $25 million. It will be interesting to see what they do with this investment.

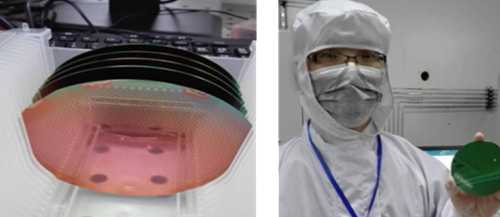

The other exciting market entrant is RH Genetech (Rene-α), who use solid state nanopore technology promising 15 000 bp and 20Gb of data – pictured below. The company, incorporated in 2019, held a conference at the end of 2020, presenting their first commercial product, AcidOn, to the IVD community.

Also keep your eye on Suzhou NJR - specialists in nanopore chip production. They don’t yet have a product on the market, but they’re rumored to have developed their own fourth-generation sequencer.

Contact us for help identifying new technologies in China

Biochip technology

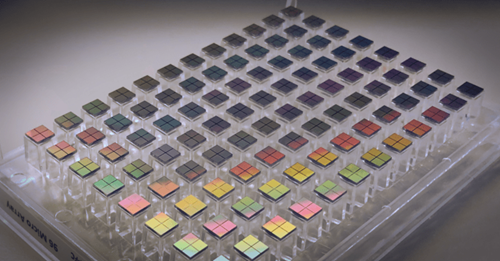

In the biochip space, a Sino-US company, Centrillion, is one of the few MDx firms successfully to manufacture high-density gene chip technology. Centrillion’s chip is suitable for the in-situ analysis of DNA, RNA and proteins in two-dimensional and three-dimensional tissue sections.

Today, the company has commercialized several genotyping assays, (illustrated below) with target panels including human, swine, HPV and SARS-CoV-2. And Centrillion have received more than USD $86 million in equity investments.

See our reports on the medical sector in Japan, Korea & Taiwan

Cancer

Detection of cancer in China tends to be at a relatively late stage, leading to higher mortality compared with western countries. China has a strategic plan to address this through preemptive interventions, and this focus has created a lively market with many new entrants.

SeekIn offer peripheral, blood-based, non-invasive, AI + big data-powered pan-cancer screening solutions. They use a multi-omics approach incorporating genomic and epigenetic alterations in conjunction with protein biomarkers, analyzed by machine learning technology to generate a multivariate cancer risk score (MCRS). This model can be used to identify cancer patients within a population.

AnchorDx provide a Next Generation Sequencing (NGS)-based, non-invasive test for single-cancer, multi-cancer and pan-cancer screening - all aimed at early detection. AnchorDX have already received recognition and strategic investments worth more than USD $70 million from companies including Wuxi AppTec and KingMed Diagnostics.

Other interesting MDx companies in this space include New Horizon Health, Laboratory for Advanced Medicine, 3D Medicines, Precogify (ZJPL) and Predicine.

Ideal market

So, the Chinese MDx space is fast evolving. With a history of delivering high-tech equipment to international technology owners, it’s now exciting to watch Chinese startups both develop their own technologies and license foreign tech to create unique solutions.

The size and scope of the Chinese MDx industry, along with its rate of evolution, makes China an ideal market to find pioneering partners and scout for innovative technologies.

To discuss the opportunities for your MDx business in the complex Chinese market, don't hesitate to get in touch.

Subscribe for our East Asia Updates